Still No Fear on the Horizon

August 18, 2025

Market Roundup for the Week

Looking for the simplest reason why the markets have seemingly gone up in a straight line this summer? It's not necessarily because of the potential for a 25 basis point rate cut at the Fed's September meeting. That cut might not be as significant as the rocket fuel provided by this earnings season.

According to FactSet data, 81% of S&P 500 companies have reported positive earnings per share surprises. 81% of S&P 500 companies have also reported a positive revenue surprise. Sectors with above-80% earnings beat scores include Industrials, Health Care, Financials, Consumer Staples, Real Estate, and Information Technology. Companies that have issued positive guidance have trumped those issuing negative guidance.

Second quarter earnings growth is clocking in at 11.8%, the third straight quarter of double-digit growth for the S&P 500. Overall, the term "recession" was cited on 16 earnings calls conducted by S&P 500 companies this earnings season, according to FactSet. This number is trending well below the five-year average of 74 and the 10-year average of 61.

It appears that executives have quickly been able to move to blunt Trump's supply chain chaos. Many companies have now built structural safeguards into their businesses to preserve profits from tariff hits. And if Team Trump chills out, the structural shifts could unlock even better earnings potential.

Tariff inflation concerns do lurk in the third quarter and companies will enter the third quarter earnings season with above-historical valuations and expectations of strong 2026 outlooks.

Strategy Corner

Based on last week's market movements, here are some trading ideas and option strategies for the readers' consideration. The positions can be scaled bigger if suitable for larger accounts.

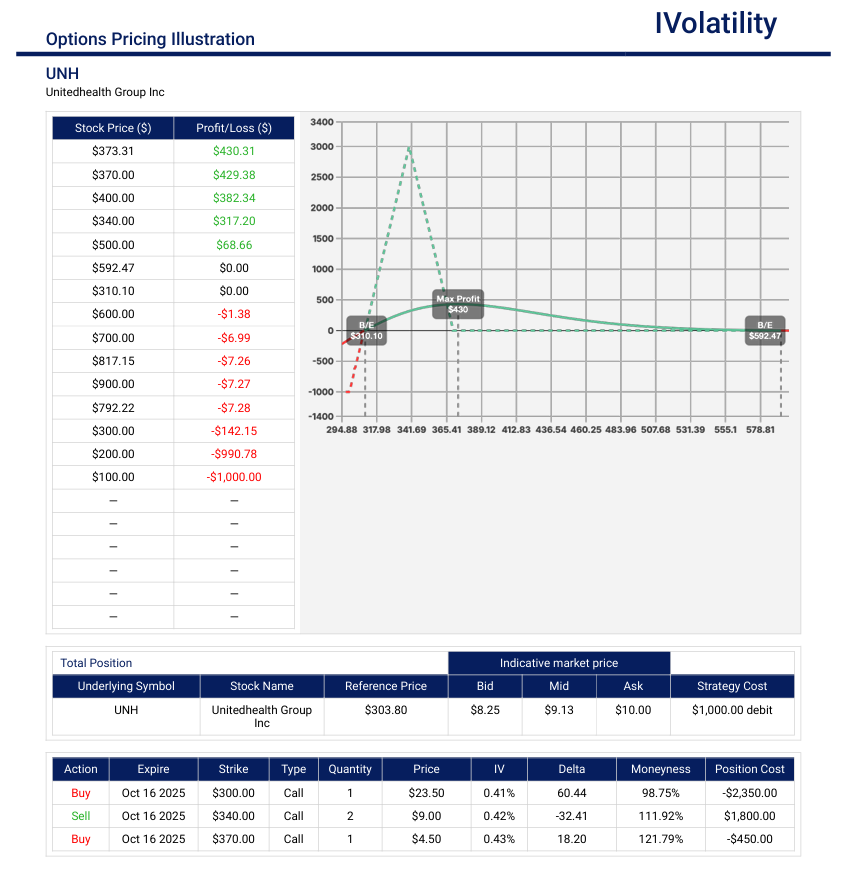

- UNH (closed around 304 on Friday, Aug 15th)

If bullish, then the purchase of a skewed call butterfly (40 by 30) can be considered

For October 17th expiration, buy one 300call / sell two 340calls / buy one 370call

Debit paid: $913

Max potential profit: approximately $3000 (if UNH pins 340 at expiration)

PnL Calculator from the IVolLive Web - NFLX (closed around 1239 on Friday, Aug 15th)

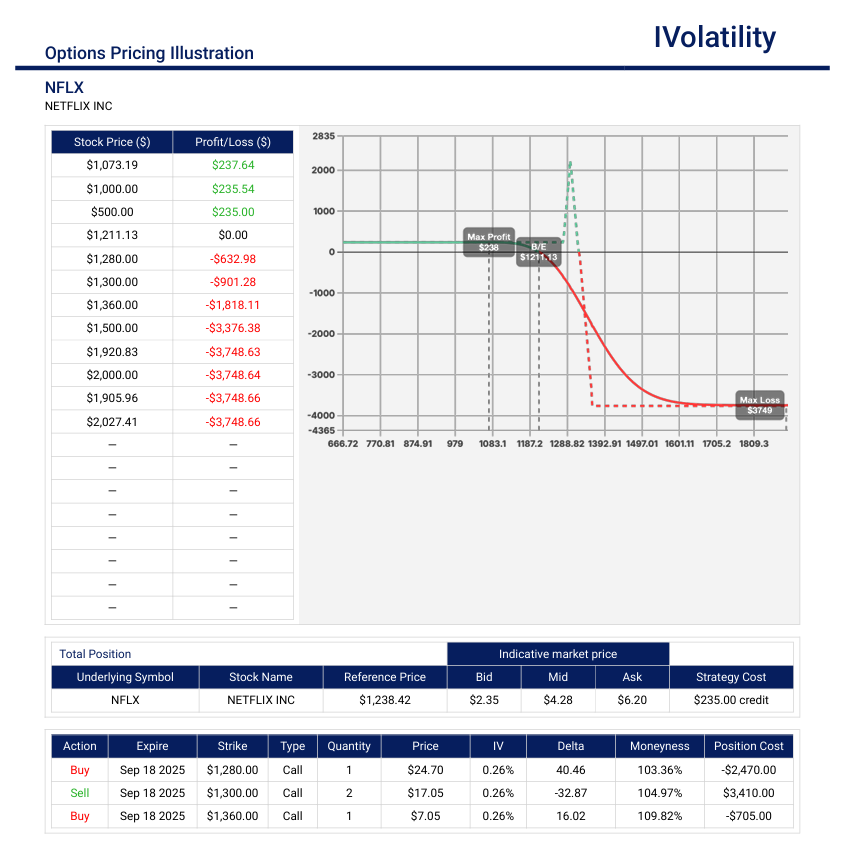

This underlying has had a steady upward move for the past few weeks. If a potential max value of $1300 seems reasonable, then a call broken-wing butterfly could be a position to be considered.

For September 19th expiration, buy one 1280call / sell two 1300calls / buy one 1360call

Credit collected $430 / buying power held $3600

Upside breakeven around 1324 / no risk to the downside

Max potential profit: $2430 (if NFLX pins 1300 at expiration)

PnL Calculator from the IVolLive Web

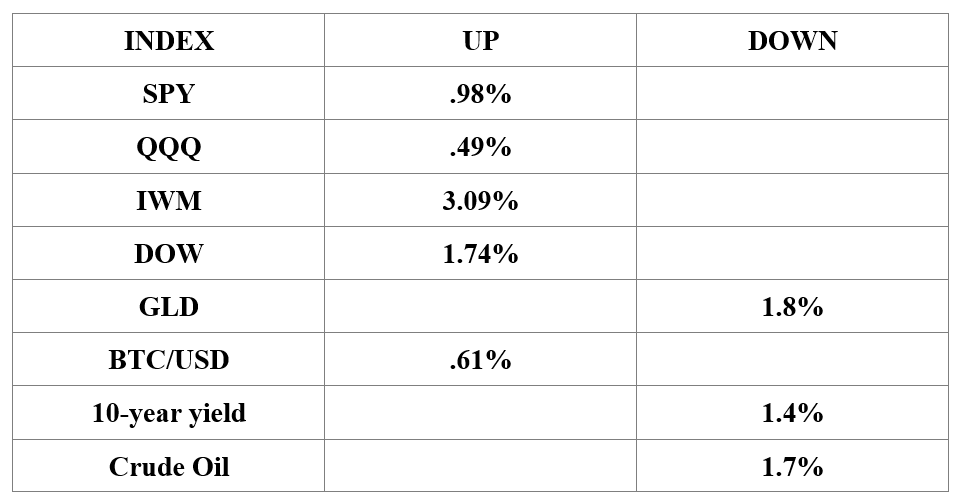

Weekly changes in Major Indices

Review selected market profiles below:

Top Daily Headlines

Monday's Recap:

Markets struggled to pick a direction as investors took a wait-and-see approach ahead of tomorrow's CPI reading – even as Wall Street worries about the data's reliability.

President Trump asked China, the world's largest soybean buyer, to quadruple its soybean purchases from the US. He also extended the trade war truce with China by 90 days.

Gold had its worst day in three months as traders waited for the White House to clarify its new tariffs on the key commodity – only for Trump to announce that it won't be tariffed at all. Meanwhile, Chinese battery giant CATL halted operations at a mine that produces 4% of the world's lithium, sending prices of the precious metal soaring.

Notable movers to the upside:

- Fannie Mae and Freddie Mac rose significantly after President Trump posted an AI-generated image of himself ringing the bell at the NYSE, suggesting the two mortgage giants could be combined into one stock with the ticker MAGA

- Marijuana stocks got high on their own supply after Trump told reporters that he may soon reclassify marijuana in "the next few weeks". Canopy Growth soared over 25% and TilrayBrands jumped over 40%

- Tesla rose nearly 3% on the news that it has launched a bid for an energy license in Britain that would allow it to enter the UK energy market

- Mega miner Albemarle popped 6.97% after a Chinese lithium giant halted production, cutting the supply of the precious metal

- Parent company TKO Group rose over 10% when Paramount acquired the rights to UFC for $7.7 billion over the next seven years

- Tegna soared nearly 30% on reports that the television station operator will be acquired by Nexstar Media Group

Notable movers to the downside:

- Ce.ai plunged over 25% after the AI software maker missed Wall Street analyst estimates (perhaps due to its CEO's health struggles)

- Hershey dropped nearly 5% after cocoa futures surged the most since December as traders worried about a weak West African crop

- Monday.com beat earnings estimates and raised its fiscal guidance, but the workflow management company lost nearly 30% after that guidance came in lower than expected

Tuesday:

Markets aced a crucial test today, as the S&P 500 zoomed to another record after the tame July inflation report supported a Fed rate cut in September. The rate-sensitive Russell 2000 index of small companies leapt 2.5%, and short-dated bond yields dipped.

Notable movers to the upside:

- Intel gained over 5% after CEO Lip-Bu Tan made a good impression on President Trump during a visit to the White House on Monday. Trump, who called for Tan's firing last week, wrote on Truth Social that Tan's "success and rise is an amazing story"

- On, the Swiss sportswear brand jumped nearly 9% after posting revenue growth of 32% last quarter and raising its full-year sales guidance. The company reported that it has not seen "any negative impact" from raising prices due to tariffs

- Circle's first earnings as a public company reported revenue jumping 53% thanks to stablecoin growth. Shares gained over 1% on the day

- Hanesbrands soared over 28% following a report that the Michael Jordan-endorsed underwear maker is close to being acquired by Canada's Gildan Activewear

- AST SpaceMobile, which wants to take on SpaceX's Starlink, jumped over 8% after confirming it has the funds to deploy 45-60 satellites by next year

- Opendoor popped nearly 7% when crypto influencer and investor Anthony Pompliano said he purchased a stake

Notable movers to the downside:

- Eastman Kodak, the 133-year-old camera pioneer, collapsed over 20% after warning it could potentially go out of business if new funding is not secured

- Spirit Airlines's parent company cratered over 40% for issuing a "going concern" warning. Note that bigger, more established airlines Delta and United surged

- AI software firm BigBear.ai plunged over 15% following a rough earnings miss Monday afternoon. CEO Kevin McAleenan pointed to "disruptions" in federal contracts due to the Trump administration's efficiency drive

- Celanese, a chemicals company, tumbled over 13%, because it reported a "softening demand environment across most key end-markets in the second half of the year"

- Cardinal Health was the worst performer in the S&P 500 today, down over 7%, after the healthcare company missed revenue expectations last quarter

Wednesday:

The S&P 500 and Nasdaq ended the day at record highs, even after giving up some early gains as investors rotated out of large caps and focused on small caps in the Russell 2000.

Treasury Secretary Scott Bessent called for the Federal Reserve to slash interest rates by a jumbo 50 basis points in September.

Ether continued to lead the altcoin rally, buoyed by strong ETF inflows and general trader enthusiasm for all things crypto.

Notable movers to the upside:

- Webtoon Entertainment nearly doubled in price after the online comic platform reported a surprise profit, strong sales, and a new deal with Disney

- Small stocks that pivot into crypto treasuries continue to pop – and the latest is 180 Life Sciences Corp., which rose nearly 5% on the news that it will rebrand itself as ETHZilla in honor of its $350 million hoard of Ethereum

- SailPoint popped over 5% after JPMorgan analysts upgraded the identity management software provider from "neutral" to "overweight" now that its IPO lockup period is over

- Paramount Skydance skyrocketed nearly 40% after the newly merged entertainment company became the latest meme stock

Notable movers to the downside:

- Cava shares fell over 16% bringing it down nearly 40% in 2025. It was the latest fast-food chain to release a disappointing Q2 earnings report. Although EPS came in above expectations, revenue fell short. This miss was chalked up to lackluster same-store sales growth year over year and a cut back in its full-year forecast

- KinderCare Learning plunged over 20% after the early childhood education provider missed estimates for both sales and profits last quarter

- Circle tumbled over 6% after the company reported a bigger net loss than expected

- CoreWeave lost nearly 21% after the AI data center company beat revenue estimates but fell well short of profit forecasts and warned of high expenses ahead

- H&R Block, the tax prep service dropped over 3% after fiscal guidance for the coming year came in weaker than expected

Thursday:

Markets took a turn for the worst after shockingly bad PPI data sidelined high hopes of multiple rate cuts coming in September. But the S&P 500 did make a late-afternoon comeback as investors did show up again to buy the dip.

Bitcoin touched a new record high just above $124,000 before traders sold in bulk to collect profits.

Notable movers to the upside:

- Bullish continued living up to its name, rising another 7% a day after its red-hot IPO

- Miami International Holdings surged over 35% on its first day of trading

- Intel popped over 7% on reports that the Trump administration is considering taking a stake in the semiconductor company

- DLocal soared over 30% thanks to a 50% increase in revenue last quarter for the online payment company

- Equinox Gold gained over 15% after the miner produced 219,122 ounces of gold last quarter – the same quarter gold prices hit several new all-time highs

- Netflix seemed to show strong institutional buying activity

Notable movers to the downside:

- Coherent plunged nearly 20% after the AI company beat Wall Street's expectations last quarter, but failed to live up to its forecasts for the coming quarter

- Deere & Co. surpassed analyst estimates last quarter, but still dropped nearly 7% as investors noticed that the company has been forced to cut prices to keep customers interested

- Ibotta plummeted over 30% after the tech company grossly missed Wall Street estimates and lowered its fiscal guidance

- Cisco Systems beat analyst expectations by a hair and issued guidance that was in line with forecasts, but the "meh" report still pushed shares 1.38% lower

- Advance Auto Parts sank 8% after the car parts company fell short of estimates last quarter and lowered its outlook for the rest of the year

Friday:

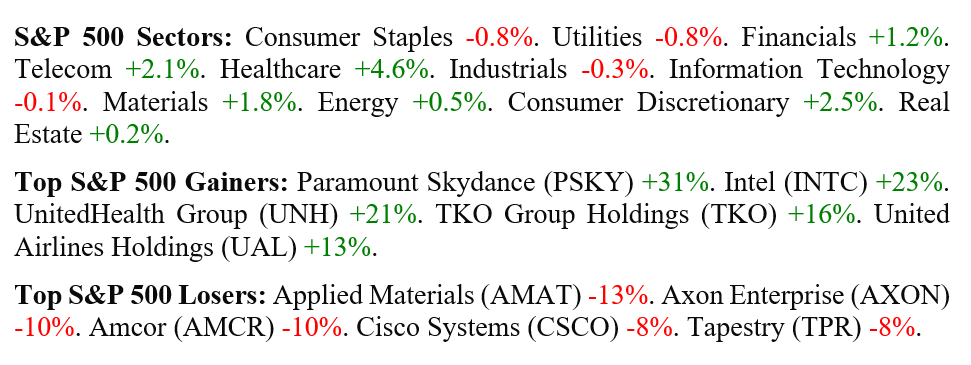

The Dow climbed (mostly due to United Healthcare) while the rest of the market sank as the rally took a breather. Despite today's decline, both the S&P 500 and Nasdaq wrapped up winning weeks.

Both 10-year and 2-year Treasury yields continued to climb after Thursday's PPI reading and today's consumer confidence and retail sales data.

All eyes were on Anchorage, Alaska as President Trump arrives for talks with President Putin – discussions that will be crucial for crude's future.

Stocks ended the day mixed, after investors looked at all the latest economic data, which was also mixed.

Notable movers to the upside:

- Intel climbed nearly 3% more after reports broke that the Trump administration may take a stake in the chipmaker

- Salesforce jumped nearly 4% on the news that activist investor Starboard Value has increased its stake in the software company by almost 50%

- Homebuilders enjoyed a Buffett Bump after it was revealed that he bought shares of DR Horton and Lennar

- Twilio jumped nearly 5% on the news that the cloud software developer will be added to the S&P MidCap 400

- Evolv Technologies popped over 5f% after the AI security company reported strong earnings and that the Justice Department has ended its investigation

- Thanks to strong earnings from SunRun combined with new tax credit guidance from the government, solar stocks jumped. SunRun soared 32.82%, First Solar rose 11.05%, and Enphase Energy gained 8.13%

- UnitedHealth Group soared almost 12%, its biggest one-day gain in nearly five years, after getting the Buffett Bump. Buffet's Berkshire Hathaway revealed Thursday night it had bought ~5 million shares worth nearly $1.6 billion, giving a much-needed vote of confidence to the struggling health giant. The "Big Short" investor Michael Burry and Appaloosa Management's David Tepper also disclosed sizable stakes in the company

Notable movers to the downside:

- Target lost over 1% after Bank of America analysts downgraded the retailer and cut their price target, citing a weaker long-term outlook. Ulta Beauty and Target also agreed to end their partnership

- Roblox dropped over 6% on the news that Louisiana's attorney general is suing the video game company for allegedly being "the perfect place for pedophiles"

- Applied Materials may have beaten Wall Street's estimates last quarter, but the semiconductor equipment maker still fell over 14% after guidance for the current quarter came in lower than expected

- Sandisk tumbled nearly 5% after the data storage provider's margins tightened up dramatically last quarter thanks to high costs

- Standard Chartered sank over 7% on the news that a US lawmaker has asked the attorney general to investigate the bank's practices

- Cisco, the networking equipment maker dropped 3% after HSBC downgraded Cisco to hold from buy and lowered its 12-month price target. The bank cited lukewarm quarterly results from Cisco earlier this week, saying that "though the company reported more than $2bn of AI infrastructure orders in FY25, strength seems to be getting offset by weakness elsewhere"

Considerations for the coming week

Economic Data Releases:

Wall Street's focus during the coming week will be on the annual Jackson Hole Economic Policy Symposium to be held from August 21st to 23rd. In terms of economic data, investors will be receiving the minutes of the Fed's July monetary policy committee meeting on Wednesday, followed by S&P flash PMIs on Thursday.

The Jackson Hole gathering will see some of the world's most well-known central bankers, economists, and financial experts convene in Kansas City. The theme this year is "Labor Markets in Transition: Demographics, Productivity, and Macroeconomic Policy." With the Federal Reserve's dual mandate of price stability and maximum employment coming under pressure after concerning jobs and inflation data this month, market participants will be watching the symposium keenly for any clues on the central bank's future actions.

Earnings Reports:

Some notable earnings reports due out during the week of Aug 18th – 22nd are:

Monday: Palo Alto Networks (PANW), Fabrinet (FN), Agora (API), and Blink Charging (BLNK)

Tuesday: Home Depot (HD), Medtronic (MDT), and Keysight Technologies (KEYS)

Wednesday: Lowe's (LOW), Analog Devices (ADI), Target (TGT), and Baidu (BIDU)

Thursday: Walmart (WMT), Intuit (INTU), Workday (WDAY), and Zoom Communications (ZM)

Friday: BJ's (BJ) and Buckle (BKE)

Closing Thoughts

There are many reasons cited for the S&P 500 to keep ascending despite the highest tariffs in nearly a century, one of which could be AI.

The gap between how humans and AI interpret the market is widening. In fact, computer algorithms haven't been this more bullish on stocks than humans since 2020, according to Deutsche Bank data cited by Bloomberg.

A chasm is emerging between those looking at the data themselves and those using algorithms to invest. While some investors see a storm gathering and cutting their equity exposure as a result, others relying more on computers to guide them are largely seeing sunny skies ahead.

The reason for this dichotomy is that while quant firms use complex strategies that factor in momentum and volatility signals, investors who apply a more human touch look at signals such as earnings and broader macroeconomic data to guide investments, according to Bloomberg.

As professional traders lean into computer-driven strategies, retail traders have begun experimenting with their own, simpler version: ChatGPT. But despite its seemingly infinite treasure trove of information, AI isn't a miracle stock predictor, and studies testing how ChatGPT compares to fund managers have been mixed.

Chatbots have been documented to be sycophantic. The problem with relying on them to tell you what to do with your portfolio? They'll look at the market with those same flattering eyes, too. AI doesn't have the same human anxieties about labor department data, tariffs, or geopolitical conflict. That can be helpful for investors using it, because it provides a counterbalance to the day-to-day market moves that can cause needless panic selling. On the other hand, it can cause blind optimism, Axios notes.

Since stock markets have existed, investors have been trying to crack the code to picking lucrative, individual stocks. But there's a reason broad indexes consistently beat most professional money managers: Nobody knows the future... but does ChatGPT know it?

Questions / Comments

We're here to serve IVolatility users and we welcome your questions or feedback about the option strategies discussed in this newsletter. If there is something you would like us to address, we're always open to your suggestions. Use support@ivolatility.com.

Previous issues are located under the News tab on our website.